XRP Price Prediction: Holding $3 Support as XRP Trades 20% Below Peak

XRP Price Consolidation and Volatility

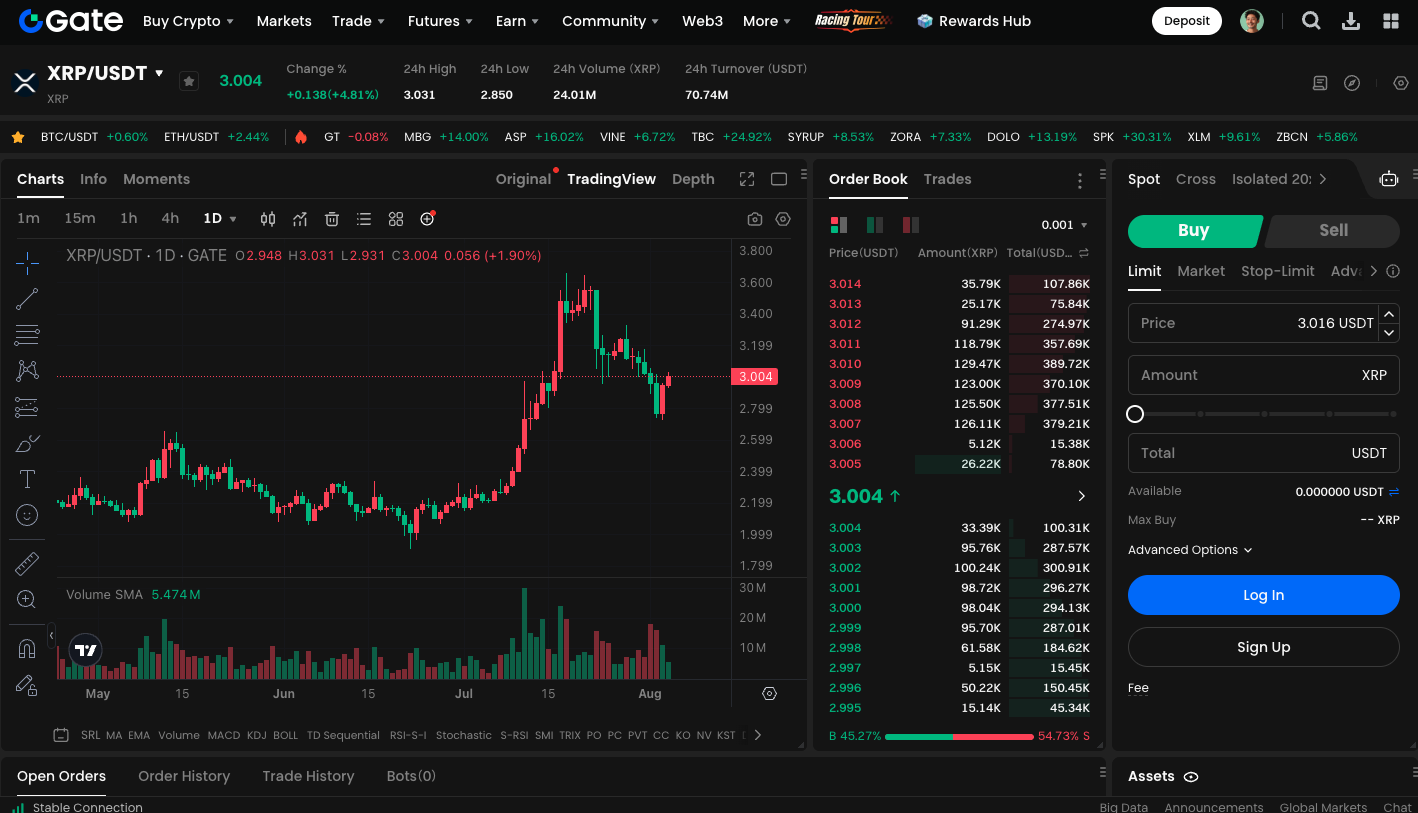

In the past 48 hours, XRP has jumped approximately 10%, fluctuating between $2.75 and $3.00, indicating the asset has entered a period of consolidation. While the recent rebound couldn’t push XRP above the $3.10 mark for long, it highlights that bulls remain active. Short-term investors have not fully exited the market.

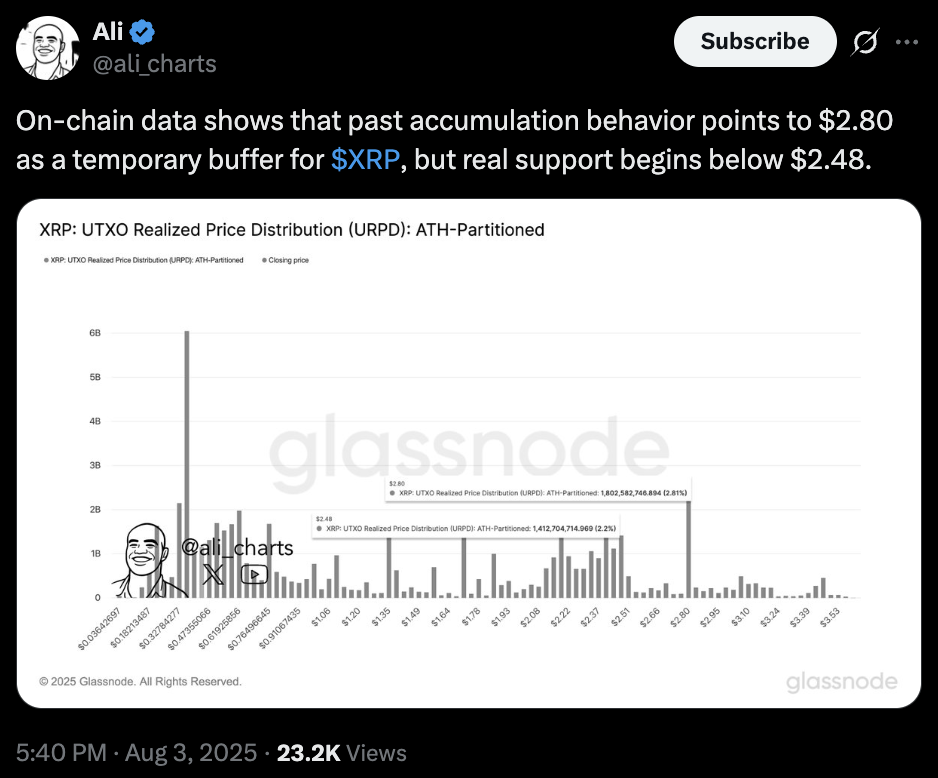

On-chain analytics expert Ali Martinez highlights that around 1.8 billion XRP were aggressively accumulated near $2.80, suggesting this zone could offer temporary support in the near term. However, a more substantial and strong support level is located around $2.48, where approximately 141 million XRP changed hands within that range.

(Source: ali_charts)

XRP Technical Signals

Technical analyst CRYPTOWZRD adds that if the daily chart can hold above $3.20, XRP may be able to break through the next resistance at $3.30 and the previous high of $3.65. Conversely, if XRP fails to stay above this level, the price is likely to continue consolidating in the $2.80 to $3.03 range.

Whale Selling Sparks Short-Term Volatility

Market tracking platforms report that, since XRP’s July highs, some large holders have started to cash out, selling more than 700 million XRP—worth roughly $2.1 billion—in just one day, which added short-term pressure to the market. Although this move may be tied to profit-taking, it has driven retail investors to stay on the sidelines and weakened overall bullish sentiment.

XRP spot trading: https://www.gate.com/trade/XRP_USDT

Summary

XRP is currently in a pivotal consolidation phase, with the $3.00 psychological level experiencing significant buying and selling pressure from both bulls and bears. If the $2.80 support range holds, and there’s a strong-volume breakout above $3.20, the price could once again challenge this month’s highs. However, market structure continues to exert downward pressure, especially as whales take profits and technical warning signals emerge. Short-term traders should control risk and closely monitor critical support levels.